- Mint Cookies

- Posts

- Inflation: An Economic Gremlin

Inflation: An Economic Gremlin

Table of Contents

TL;DR

We give an introduction to inflation and how it crippling it can be when personal finance doesn’t keep up

Consumer Price Index and how it relates to what we buy

Deflation and how it is usually not good.

Stagflation - how it affects prices and how it can be a good time to make investments

Inflation: A Menace of Economics

Inflation is a phantom that does egregious deeds and doesn’t want you to look at it. It throws rocks and hides its hands. Inflation rates consistently skyrocket year after year.

Since the year 2000, what cost $1.00 then, costs $1.82 today. That’s an 82.4% increase. 10 years before that, $1.00 in 1990, is $2.40 today.

That’s a whopping 140.3% increase. One more stat for effect is 10 years before that $1.00 in 1980 is $3.81 today. That’s a 281.2% increase.

The inflation rate reacts to phases of the business cycle. Central banks attempt to keep the inflation rate at a certain target. The Federal Reserve has a target annual rate of 2%.

It uses monetary policy to keep inflation from getting out of hand and stabilizes the economy when inflation rises above the set benchmark.

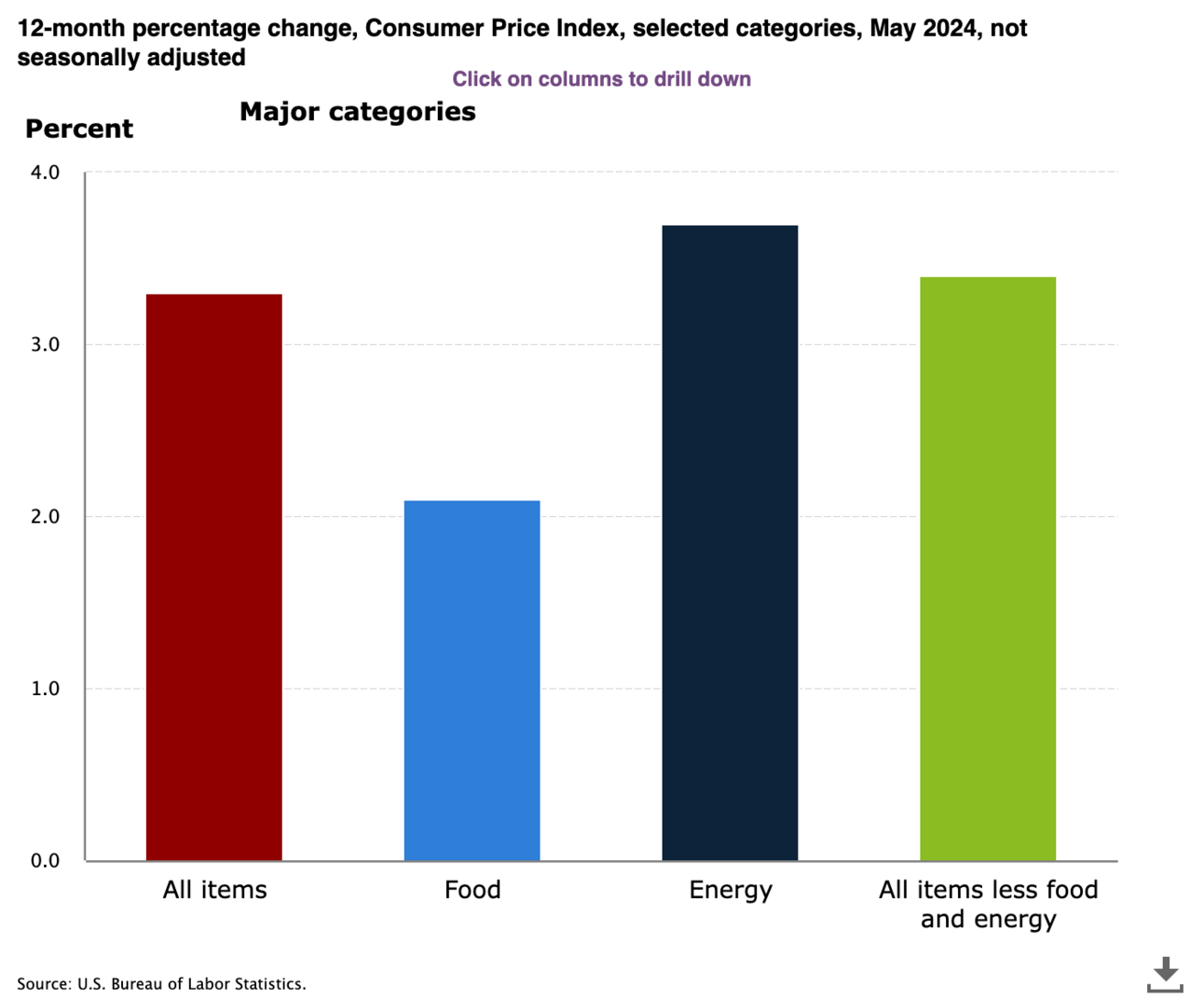

CPI:

The consumer price index is a measure of how prices of goods and services change on average over time when paid by urban consumers.

Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.

When you start hearing about prices of milk, eggs, blueberries, and other everyday foods, the consumer price index may be the next place you want to look to find out more.

Deflation

- 🔑 Consumers want lower prices, but deflation signals a struggling economy and is not desirable.

- 📉 Deflation occurs when overall prices fall, leading to decreased consumer spending and economic slowdown.

- 🌱 Disinflation, with prices rising slowly while wages also increase, is a more favorable outcome.

- 📦 Some prices are dropping for items like appliances and furniture after pandemic-related supply chain issues resolved.

- 💰 While lower prices for certain goods may be welcome, widespread deflation is typically a sign of economic distress.

- 🎯 The goal is for moderate inflation around 2%, not falling prices across the board.

Stagflation

- 🗺️ Stagflation is a combination of high inflation, slow economic growth, and high unemployment rates.

- ⚙️ Rising commodity prices, especially for oil and food, can trigger stagflation by increasing costs for businesses and consumers.

- 💰 Policymakers face a dilemma during stagflation, having to choose between rampant inflation or higher unemployment rates.

- 📉 While inflation remains elevated, the U.S. economy currently shows resilience with a low unemployment rate and falling commodity prices, reducing the likelihood of stagflation.

- 🏡 Diversifying investments across real estate, gold, commodities, and dividend-paying stocks can help hedge against potential stagflation.

- 🤑 Contrarian investing by buying quality stocks during market downturns can present long-term opportunities during economic contractions like stagflation.

- ⏳ Being patient and recognizing when others are fearful can unveil attractive entry points for investments during stagflationary periods.

Conclusion

Much of the time inflation and its related components are either misunderstood or fly under the radar of altogether. We shall bring weekly updates of what inflation is doing.

Understanding of economics is beneficial. The more we know, the better decisions we can make.